Neuralink Details

Explain Neuralink.

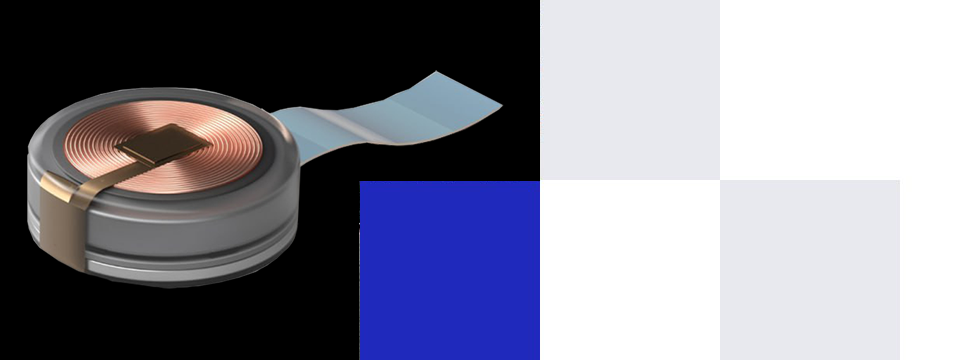

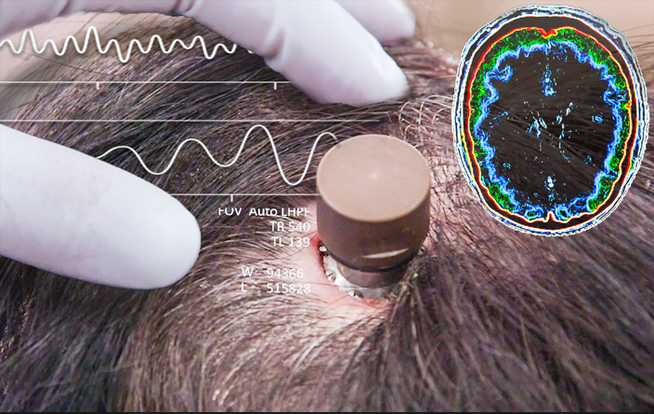

Elon Musk and a group of engineers co-founded Neuralink in San Francisco in 2016. The business is developing a microchip that a surgical robot will insert into a person’s brain. The gadget’s sensors will detect brain activity and may even stimulate specific brain regions. Neuralink is certain that its technology will be able to heal paralysis, rehabilitate motor function, and treat a variety of neurological illnesses.Such technology has a wide range of uses in entertainment, science, and even medicine. Amputees of limbs will be able to operate robotic prosthetic limbs. It would be possible to control video game characters without a joystick by sending mental commands to a smartphone or other smart devices.

Opportunities

Our dependence on cellphones as extensions of ourselves emphasizes how much we are currently like cyborgs. We can only send and receive information at a certain rate, though. Neuralink tries to overcome this drawback.Neuralink Offers a Wealth of Opportunities, including:

- Providing robotic prosthetics that are controlled by electrical signals transmitted by paraplegics' brains to assist them regain their mobility.

- Restoring hearing and providing those who have never had it with eyesight.

- The capacity to upload memories to an artificial intelligence system housed on a cloud server, preventing memory loss with age.

- Greater capacity to acquire and retain fresh information.

Typing, chatting, and online browsing by just visualizing necessary moves.

Interacting with virtual reality, playing video games, or even directly receiving data inputs like text messages or movies without the use of a monitor.

Long-distance psychic communication is possible without the aid of technology like computers or cell phones.

Financials

Neuralink has raised a total of $368 million from a number of investors, including Sam Altman’s Craft Ventures, Google Ventures, Peter Thiel’s Founders Fund, and others.Risk

Typical dangers of private company investingRegulator vigilance and reputational harm. Controversies surrounding Neuralink’s use of animals in research has subjected the company to regulatory oversight, including delays in product approval, damage to its reputation, and legal and financial implications, posing threats to its business operations and competitive position.

Competition.

Neuralink’s market dominance may be threatened by competition from a number of businesses in the implant development industry. In contrast to Neuralink’s Link, Synchron, an Australian implant company, provides a less invasive implant version that doesn’t call for a skull incision. Blackrock’s Neurotech research-focused implant project has received FDA permission for human testing. Other firms in the space are fighting for a spot in this developing market, including BrainCo, Kernel, and CTRL-Labs (now a part of Meta’s virtual reality subsidiary). These rivals challenge Neuralink’s position in the market and demonstrate the growing interest and investment in brain-machine interface technology.

Offering

Deal OrganizationInvestors in Neurofusion Holdings will have a secondary route to Neuralink via Neurofusion Holdings Fund. This fund will invest in shares of a fund that already owns Neuralink stock. As an alternative, it might sign derivative arrangements, like forward contracts, with the fund or a worker who owns Neuralink stock.

Accredited investors are offered shares in Neurofusion Holdings Fund, and after they sign a subscription agreement, they join the fund as members.